NS&I announces cut to Premium Bonds prize fund rate in blow to savers - slashing number of high value prizes from August

NS&I has announced the Premium Bonds prize fund rate will be cut within months.The prize fund rate will be reduced from 3.8 per cent to 3.6 per cent from the August 2025 prize draw.The change means there will be fewer high-value tax-free prizes available however the odds of winning stay the same.Andrew Westhead, NS&I Retail Director, said: "This adjustment to the Premium Bonds prize fund rate – the first in four months – reflects the changing landscape for savings."Premium Bonds maintain their unique appeal by offering complete security backed by HM Treasury, the flexibility to withdraw easily, and the excitement of potentially winning a tax-free prize each month. "The August draw is expected to deliver more than 6 million tax-free prizes worth over £396 million."By making this adjustment now, we’re able to continue to balance the interests of savers, taxpayers and the stability of the broader financial services sector."More than six million prizes will still be paid out in the August draw, but several prize categories will see a drop in the number of winners.Here is the prize breakdown in bullet point format for August 2025 (estimated), compared with June 2025: £1 million prizes: June: 2 August: 2 £100,000 prizes: June: 79 August: 75 £50,000 prizes: June: 159 August: 151 £25,000 prizes: June: 317 August: 302 £10,000 prizes: June: 792 August: 754 £5,000 prizes: June: 1,585 August: 1,507 £1,000 prizes: June: 16,649 August: 15,869 £500 prizes: June: 49,947 August: 47,607 £100 prizes: June: 1,853,552 August: 1,687,680 £50 prizes: June: 1,853,552 August: 1,687,680 £25 prizes: June: 2,197,831 August: 2,569,568Since November 1956, Premium Bonds have offered savers an accessible way to save, with the chance to win tax-free prizes. Instead of paying interest, there’s an annual prize fund rate that funds the monthly draw for tax-free prizes. Each £1 Bond purchased is entered into a monthly prize draw, where prizes range from £25 to £1 million, making it an engaging way to save.Individuals can hold up to £50,000 in Premium Bonds, including those aged under 16. Premium Bonds offer the security of being 100 per cent backed by HM Treasury, alongside the excitement of potentially winning tax-free prizes. Nine out of ten prizes are paid directly into the holder’s nominated bank account or automatically reinvested into Premium Bonds to go into the next draw. New Premium Bonds purchases need to be held for one full calendar month before being entered into the monthly prize draw.Key changes for August 2025: Prize fund rate cut from 3.80 per cent to 3.60 per cent tax-free Odds remain unchanged at 22,000 to 1 Estimated total prize payout: £396.7 million Number of prizes: Over 6 million

NS&I has announced the Premium Bonds prize fund rate will be cut within months.

The prize fund rate will be reduced from 3.8 per cent to 3.6 per cent from the August 2025 prize draw.

The change means there will be fewer high-value tax-free prizes available however the odds of winning stay the same.

Andrew Westhead, NS&I Retail Director, said: "This adjustment to the Premium Bonds prize fund rate – the first in four months – reflects the changing landscape for savings.

"Premium Bonds maintain their unique appeal by offering complete security backed by HM Treasury, the flexibility to withdraw easily, and the excitement of potentially winning a tax-free prize each month.

"The August draw is expected to deliver more than 6 million tax-free prizes worth over £396 million.

"By making this adjustment now, we’re able to continue to balance the interests of savers, taxpayers and the stability of the broader financial services sector."

More than six million prizes will still be paid out in the August draw, but several prize categories will see a drop in the number of winners.

Here is the prize breakdown in bullet point format for August 2025 (estimated), compared with June 2025:

- £1 million prizes:

- June: 2

- August: 2

- £100,000 prizes:

- June: 79

- August: 75

- £50,000 prizes:

- June: 159

- August: 151

- £25,000 prizes:

- June: 317

- August: 302

- £10,000 prizes:

- June: 792

- August: 754

- £5,000 prizes:

- June: 1,585

- August: 1,507

- £1,000 prizes:

- June: 16,649

- August: 15,869

- £500 prizes:

- June: 49,947

- August: 47,607

- £100 prizes:

- June: 1,853,552

- August: 1,687,680

- £50 prizes:

- June: 1,853,552

- August: 1,687,680

- £25 prizes:

- June: 2,197,831

- August: 2,569,568

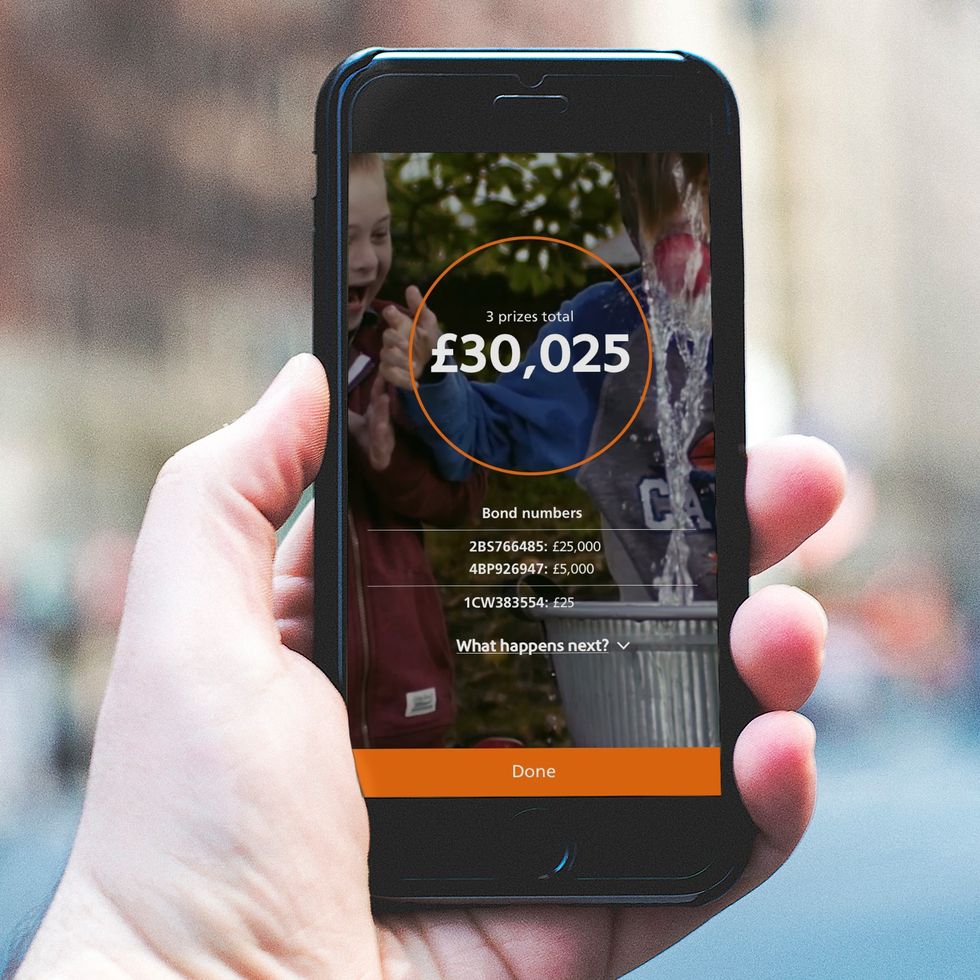

Since November 1956, Premium Bonds have offered savers an accessible way to save, with the chance to win tax-free prizes.

Instead of paying interest, there’s an annual prize fund rate that funds the monthly draw for tax-free prizes.

Each £1 Bond purchased is entered into a monthly prize draw, where prizes range from £25 to £1 million, making it an engaging way to save.

Individuals can hold up to £50,000 in Premium Bonds, including those aged under 16.

Premium Bonds offer the security of being 100 per cent backed by HM Treasury, alongside the excitement of potentially winning tax-free prizes.

Nine out of ten prizes are paid directly into the holder’s nominated bank account or automatically reinvested into Premium Bonds to go into the next draw.

New Premium Bonds purchases need to be held for one full calendar month before being entered into the monthly prize draw.

Key changes for August 2025:

- Prize fund rate cut from 3.80 per cent to 3.60 per cent tax-free

- Odds remain unchanged at 22,000 to 1

- Estimated total prize payout: £396.7 million

- Number of prizes: Over 6 million