Inheritance tax grab 'putting lives at risk' says son of farmer who took own life over Budget fears

Next March could see a heightened risk of suicides among farmers before Labour's "family farm tax" takes effect, fears a bereaved farmer whose father took his own life ahead of the Budget.Jonathan Charlesworth told Robert Jenrick for GB News that the lack of time given to farmers to plan ahead of Rachel Reeves's shock tax grab means "next March will be like national suicide month, before the regulations come in." He fears elderly farmers who believe they may die before the next election, when opposition parties have promised to reverse the tax, could decide to end their lives before its imposition. "I do not by any means want anyone to do it. When you're on the other end of it, you realise that people are worth a lot more than what [assets] you're going to lose [as a result of the tax]."It's not something anyone should contemplate doing, but there will sadly be people who will feel that way - they have this [farm] and they want the next generation to have it."His father, who was known by his middle name, Philip, had lived and worked on his farm his whole life, having been passed it by his own father, who had worked two jobs to save the cash to purchase the land. Philip's plan had been to hand it down to Jonathan, who had been running the farm himself for over a decade.With an annual income of between £15,000 and £20,000 a year from the farm, the family would have struggled to pay any inheritance tax due as a result of the changes. The stress of such a prospect "obsessed" Philip: "It was all he could talk about."Philip had been caring for his wife who had dementia, and facing care costs of up to £50,000 a year should he become unable to continue doing so as he aged, his financial pressures were mounting."That kind of money eats into assets as well, but if it weren't for the inheritance tax changes, my dad would still be here. I'm sure of it", Jonathan said.LATEST DEVELOPMENTS:Lucy Connolly left bruised after being 'manhandled without provocation' while serving sentence‘It’s a confidence vote!' Starmer lays down gauntlet to Labour rebels over plan to kill welfare planCemeteries campaigner abused by roadside vows to fight on: 'I will not let them deter me!'At the inquest into Philip's death, the coroner found what has been dubbed 'the family farm tax' contributed to his death: "It's the one positive to come out of the inquest. She agreed with us", Jonathan told Robert Jenrick.Turning his ire on Chancellor, Rachel Reeves, he said: "It's the lack of understanding, I think the vindictiveness towards not just farmers, but anybody that's got any sort of entrepreneurial ambition."I think she just sees all farmers as rich folk riding around in their shiny tractors, but if you've got somebody who owns a factory, they probably have hundreds of thousands of pounds of machinery behind the walls that nobody ever sees."Our machinery is a tool of the trade, it's not a toy!"Jonathan hopes to pass the farm on to his youngest son, who has shown interest in the lifestyle. His oldest son has decided to seek better pay and conditions elsewhere."He's got a job in computing, works a four-day week and earns probably three times more than me. I don't blame him."The farm earned us about £15,000 last year. When you put the hours in, that works out at about £3.80 an hour."If a generation of young people from farming backgrounds were put off taking on the family business, Jonathan feared the implications to Britain's food security: "When you lose the farmers, you lose the talent".Jonathan found his father on the day of his death.He said: "It was the worst day of my life, that. That's an image that will stay with me for the rest of my life. I'm just so glad that the kids didn't see that.""The last six months [since Philip's death] have been such a rollercoaster, in a bad way. It's absolutely devastating."Until you've experienced suicide, you really don't understand it. It's a very, very, very different feeling to losing someone in a natural way."What my dad did, he thought he was doing it for the right reasons, but the legacy he left is not how we want to remember him."To anybody who worried about [inheritance tax], think about that. Think about not just what you're protecting, but what you're actually going to leave in somebody's head."Talking to people is key. If you can't talk to your family or friends, there are a lot of farming charities out there."Upon hearing Jonathan's story, Robert Jenrick said: "Stories like Jonathan's are sadly not as rare as they might be."Farming was a way of life for Philip, like his father before him, who worked hard to scrape together the money to buy his farm."A tax that could force our farmers to sell wouldn't just devastate their way of life, it would seriously threaten Britain's food security, our countryside and its heritage and our rural way of life."It's unfair, it's cruel, and it's having devastating consequences already."A Government spokesman said: "Any suicide is an absolute tragedy and our symp

Next March could see a heightened risk of suicides among farmers before Labour's "family farm tax" takes effect, fears a bereaved farmer whose father took his own life ahead of the Budget.

Jonathan Charlesworth told Robert Jenrick for GB News that the lack of time given to farmers to plan ahead of Rachel Reeves's shock tax grab means "next March will be like national suicide month, before the regulations come in."

He fears elderly farmers who believe they may die before the next election, when opposition parties have promised to reverse the tax, could decide to end their lives before its imposition.

"I do not by any means want anyone to do it. When you're on the other end of it, you realise that people are worth a lot more than what [assets] you're going to lose [as a result of the tax].

"It's not something anyone should contemplate doing, but there will sadly be people who will feel that way - they have this [farm] and they want the next generation to have it."

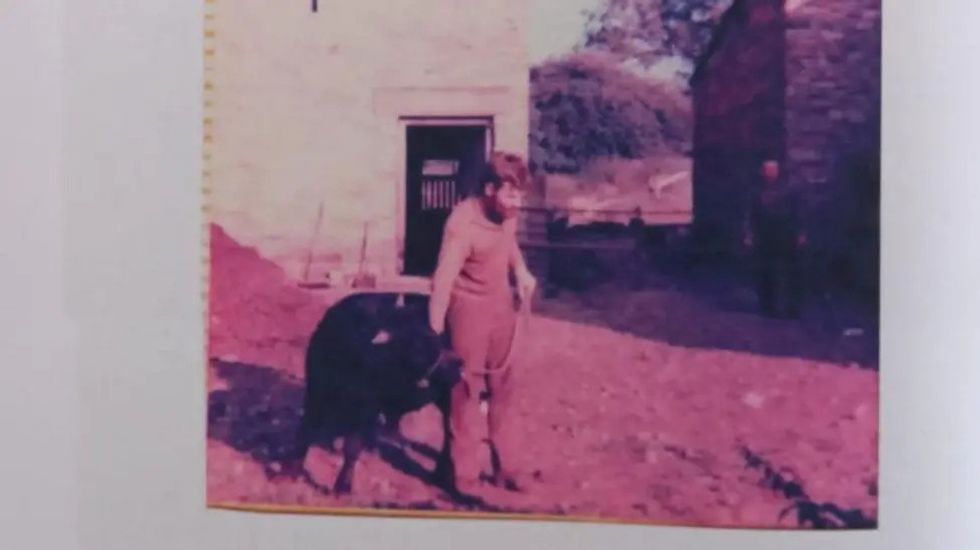

His father, who was known by his middle name, Philip, had lived and worked on his farm his whole life, having been passed it by his own father, who had worked two jobs to save the cash to purchase the land.

Philip's plan had been to hand it down to Jonathan, who had been running the farm himself for over a decade.

With an annual income of between £15,000 and £20,000 a year from the farm, the family would have struggled to pay any inheritance tax due as a result of the changes.

The stress of such a prospect "obsessed" Philip: "It was all he could talk about."

Philip had been caring for his wife who had dementia, and facing care costs of up to £50,000 a year should he become unable to continue doing so as he aged, his financial pressures were mounting.

"That kind of money eats into assets as well, but if it weren't for the inheritance tax changes, my dad would still be here. I'm sure of it", Jonathan said.

LATEST DEVELOPMENTS:- Lucy Connolly left bruised after being 'manhandled without provocation' while serving sentence

- ‘It’s a confidence vote!' Starmer lays down gauntlet to Labour rebels over plan to kill welfare plan

- Cemeteries campaigner abused by roadside vows to fight on: 'I will not let them deter me!'

At the inquest into Philip's death, the coroner found what has been dubbed 'the family farm tax' contributed to his death: "It's the one positive to come out of the inquest. She agreed with us", Jonathan told Robert Jenrick.

Turning his ire on Chancellor, Rachel Reeves, he said: "It's the lack of understanding, I think the vindictiveness towards not just farmers, but anybody that's got any sort of entrepreneurial ambition.

"I think she just sees all farmers as rich folk riding around in their shiny tractors, but if you've got somebody who owns a factory, they probably have hundreds of thousands of pounds of machinery behind the walls that nobody ever sees.

"Our machinery is a tool of the trade, it's not a toy!"

Jonathan hopes to pass the farm on to his youngest son, who has shown interest in the lifestyle. His oldest son has decided to seek better pay and conditions elsewhere.

"He's got a job in computing, works a four-day week and earns probably three times more than me. I don't blame him.

"The farm earned us about £15,000 last year. When you put the hours in, that works out at about £3.80 an hour."

If a generation of young people from farming backgrounds were put off taking on the family business, Jonathan feared the implications to Britain's food security: "When you lose the farmers, you lose the talent".

Jonathan found his father on the day of his death.

He said: "It was the worst day of my life, that. That's an image that will stay with me for the rest of my life. I'm just so glad that the kids didn't see that."

"The last six months [since Philip's death] have been such a rollercoaster, in a bad way. It's absolutely devastating.

"Until you've experienced suicide, you really don't understand it. It's a very, very, very different feeling to losing someone in a natural way.

"What my dad did, he thought he was doing it for the right reasons, but the legacy he left is not how we want to remember him.

"To anybody who worried about [inheritance tax], think about that. Think about not just what you're protecting, but what you're actually going to leave in somebody's head.

"Talking to people is key. If you can't talk to your family or friends, there are a lot of farming charities out there."

Upon hearing Jonathan's story, Robert Jenrick said: "Stories like Jonathan's are sadly not as rare as they might be.

"Farming was a way of life for Philip, like his father before him, who worked hard to scrape together the money to buy his farm.

"A tax that could force our farmers to sell wouldn't just devastate their way of life, it would seriously threaten Britain's food security, our countryside and its heritage and our rural way of life.

"It's unfair, it's cruel, and it's having devastating consequences already."

A Government spokesman said: "Any suicide is an absolute tragedy and our sympathies are with the loved ones of Mr Charlesworth."

The National Farmers Union signposts support for those within the farming community who are struggling with their mental health - Information can be found HERE.

Jonathan Charlesworth runs a community interest group to support farmers in difficulty. Donations can be made HERE.

Anyone who is in emotional distress, struggling to cope or at risk of suicide can call the Samaritans anonymously for free from a UK phone on 116 123 or go to samaritans.org.