Best savings accounts of the week: Britons urged to 'review and switch' to 7.5% interest rates - full list

Savers are being urged to take "review and switch" bank accounts before banks and building societies begin to slash interest rates later this year.Moneyfactscompare have published a list of the best savings accounts for the week beginning June, 23, 2025 with Nationwide Building Society, NatWest and Royal Bank of Scotland being featured in the ranking.Bank customers have been able to enjoy competitive savings rates in recent years thanks to recent action from the Bank of England, which has hiked the base rate.However, analysts are warning savers that the central bank is likely to slash rates in the coming months as inflationary pressures ease.Best regular savings accounts:Here is a full list of the best regular savings accounts with interest rates attached:Principality BS - 7.50 per cent AER / 7.36 GrossThe Co-operative Bank - Seven per cent AER / GrossNationwide BS - 6.50 per cent AER / GrossMelton BS - 6.50 per cent AER / GrossWest Brom BS Six per cent AER / GrossMarket Harborough BS - 5.80 per cent AER / GrossNatWest - 5.50 per cent AER / 5.37 per cent GrossRoyal Bank of Scotland - 5.50 per cent AER / 5.37 GrossProgressive BS - 5.50 per cent AER / GrossHalifax - 5.50 per cent AER / Gross.Best fixed-rate savings accountsHere is a full list of the fixed-rate savings accounts with interest rates attached: Cynergy Bank – 4.55 per cent AER / GrossVanquis Bank - 4.51 per cent AER / GrossLHV Bank – 4.50 per cent AER / GrossCastle Trust Bank - 4.51 per cent AER / GrossZenith Bank - 4.47 per cent AER / GrossFamily Building Society - 4.46 per cent / GrossOxbury Bank – 4.45 per cent AER / GrossClose Brothers Savings - 4.45 per cent AER / GrossCynergy Bank - 4.42 per cent AER / GrossGB Bank - 4.40 per cent AER / Gross.Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.Best cash ISAsHere is a full list of the best one-year fixed ISAs with interest rates attached:Castle Trust Bank - 4.31 per cent AER / GrossCynergy Bank - 4.30 per cent AER / GrossVanquis Bank – 4.26 per cent AER / GrossParagon Bank - 4.28 per cent AER / 4.27 GrossHodge Bank - 4.28 per cent AER / GrossClose Brothers Savings - 4.27 per cent AER / GrossVida Savings – 4.25 per cent AER / GrossKent Reliance – 4.25 per cent AER / GrossUnited Trust Bank – 4.25 per cent AER / GrossMarsden BS - 4.25 per cent AER / Gross.Here is a full list of the best variable ISA with interest rates attached:Chip – Five per cent AER / 4.89 per cent GrossPlum – 4.85 per cent AER / 4.79 per cent GrossMoneybox – 4.65 per cent AER / GrossTembo Money – 4.64 per cent AER / 4.54 per cent GrossVida Savings – 4.63 per cent AER / GrossVida Savings - 4.55 per cent AER / GrossTrading 212 – 4.5 per cent AER / 4.41 per cent GrossPrincipality BS – 4.5 per cent AER / GrossTeachers BS – 4.5 per cent AER / Gross. Best easy access accountsHere is a full list of the best easy access savings accounts without a bonus attached:cahoot – Five per cent AER / GrossAtom Bank – 4.75 per cent AER / 4.65 per cent GrossSnoop – 4.6 per cent AER / 4.5 per cent Grosscahoot – 4.55 per cent AER / GrossCoventry BS – 4.5 per cent AER / GrossTeachers BS – 4.5 per cent AER / GrossKent Reliance – 4.46 per cent AER / GrossSecure Trust Bank – 4.45 per cent AER / 4.36 per cent GrossClose Brothers Savings – 4.45 per cent AER / GrossNewcastle BS – 4.4 per cent AER / Gross.Here is a full list of the best easy access savings accounts with a bonus attached:Chase – Five per cent AER / 4.89 per cent GrossChip – 4.56 per cent AER / 4.47 per cent GrossSidekick – 4.51 per cent AER / 4.43 per cent GrossPrincipality BS – 4.5 per cent AER / GrossCynergy Bank – 4.3 per cent AER / GrossNottingham BS – 4.25 per cent AER / GrossSkipton BS – 4.11 per cent AER / GrossTesco Bank – 4.11 per cent AER / GrossMarcus by Goldman Sachs® – 4.01 per cent AER / 3.94 per cent GrossSAGA – 4.01 per cent AER / 3.94 per cent GrossLATEST DEVELOPMENTS:Savings crisis as bank customers risk losing more than £500 after 'falling into account trap'State pension alert: Britons could get 'early access' to payments under DWP proposalSavers urged to 'act swiftly' as inflation and interest rate cuts 'hit' returnsRachel Springall, a finance expert at Moneyfactscompare.co.uk said: "Providers have been making rate increases across the top savings rate tables over the past week, with notable attention set on short-term fixed bonds and fixed cash ISAs. Savers may then be pleased to see some competition if they are looking to secure a guaranteed return on their cash."The one-year fixed bond sector felt the most notable tweaks, with several providers improving rates or launching new deals in the top rate tables, including Cynergy Bank, Vanquis Bank, LHV Bank, Castle Trust Bank, Zenith Bank (UK) Ltd, Family Building Society, Close Brothers Savings and GB Bank.“If savers are concerned interest rates are doomed to fall towards the latter end of this year and into the next, then they may prefer to lock into a longer-term fixed bond. Thankful

Savers are being urged to take "review and switch" bank accounts before banks and building societies begin to slash interest rates later this year.

Moneyfactscompare have published a list of the best savings accounts for the week beginning June, 23, 2025 with Nationwide Building Society, NatWest and Royal Bank of Scotland being featured in the ranking.

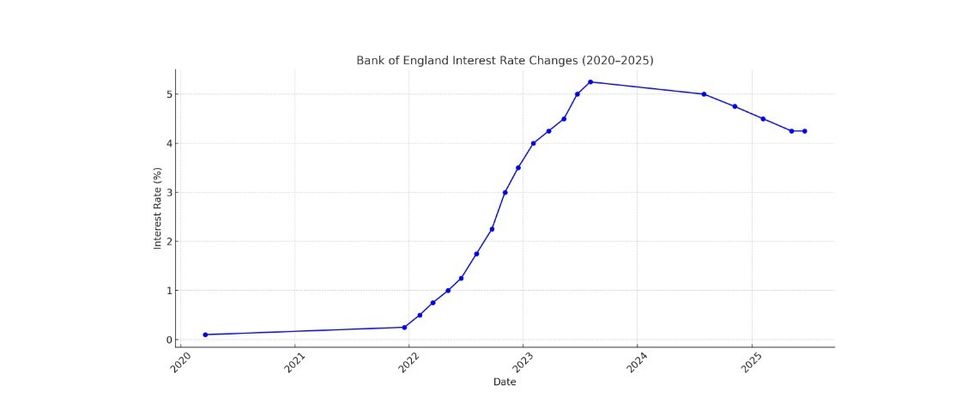

Bank customers have been able to enjoy competitive savings rates in recent years thanks to recent action from the Bank of England, which has hiked the base rate.

However, analysts are warning savers that the central bank is likely to slash rates in the coming months as inflationary pressures ease.

Best regular savings accounts:

Here is a full list of the best regular savings accounts with interest rates attached:

- Principality BS - 7.50 per cent AER / 7.36 Gross

- The Co-operative Bank - Seven per cent AER / Gross

- Nationwide BS - 6.50 per cent AER / Gross

- Melton BS - 6.50 per cent AER / Gross

- West Brom BS Six per cent AER / Gross

- Market Harborough BS - 5.80 per cent AER / Gross

- NatWest - 5.50 per cent AER / 5.37 per cent Gross

- Royal Bank of Scotland - 5.50 per cent AER / 5.37 Gross

- Progressive BS - 5.50 per cent AER / Gross

- Halifax - 5.50 per cent AER / Gross.

Best fixed-rate savings accounts

Here is a full list of the fixed-rate savings accounts with interest rates attached:

- Cynergy Bank – 4.55 per cent AER / Gross

- Vanquis Bank - 4.51 per cent AER / Gross

- LHV Bank – 4.50 per cent AER / Gross

- Castle Trust Bank - 4.51 per cent AER / Gross

- Zenith Bank - 4.47 per cent AER / Gross

- Family Building Society - 4.46 per cent / Gross

- Oxbury Bank – 4.45 per cent AER / Gross

- Close Brothers Savings - 4.45 per cent AER / Gross

- Cynergy Bank - 4.42 per cent AER / Gross

- GB Bank - 4.40 per cent AER / Gross.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Best cash ISAs

Here is a full list of the best one-year fixed ISAs with interest rates attached:

- Castle Trust Bank - 4.31 per cent AER / Gross

- Cynergy Bank - 4.30 per cent AER / Gross

- Vanquis Bank – 4.26 per cent AER / Gross

- Paragon Bank - 4.28 per cent AER / 4.27 Gross

- Hodge Bank - 4.28 per cent AER / Gross

- Close Brothers Savings - 4.27 per cent AER / Gross

- Vida Savings – 4.25 per cent AER / Gross

- Kent Reliance – 4.25 per cent AER / Gross

- United Trust Bank – 4.25 per cent AER / Gross

- Marsden BS - 4.25 per cent AER / Gross.

Here is a full list of the best variable ISA with interest rates attached:

- Chip – Five per cent AER / 4.89 per cent Gross

- Plum – 4.85 per cent AER / 4.79 per cent Gross

- Moneybox – 4.65 per cent AER / Gross

- Tembo Money – 4.64 per cent AER / 4.54 per cent Gross

- Vida Savings – 4.63 per cent AER / Gross

- Vida Savings - 4.55 per cent AER / Gross

- Trading 212 – 4.5 per cent AER / 4.41 per cent Gross

- Principality BS – 4.5 per cent AER / Gross

- Teachers BS – 4.5 per cent AER / Gross.

Best easy access accounts

Here is a full list of the best easy access savings accounts without a bonus attached:

- cahoot – Five per cent AER / Gross

- Atom Bank – 4.75 per cent AER / 4.65 per cent Gross

- Snoop – 4.6 per cent AER / 4.5 per cent Gross

- cahoot – 4.55 per cent AER / Gross

- Coventry BS – 4.5 per cent AER / Gross

- Teachers BS – 4.5 per cent AER / Gross

- Kent Reliance – 4.46 per cent AER / Gross

- Secure Trust Bank – 4.45 per cent AER / 4.36 per cent Gross

- Close Brothers Savings – 4.45 per cent AER / Gross

- Newcastle BS – 4.4 per cent AER / Gross.

- Chase – Five per cent AER / 4.89 per cent Gross

- Chip – 4.56 per cent AER / 4.47 per cent Gross

- Sidekick – 4.51 per cent AER / 4.43 per cent Gross

- Principality BS – 4.5 per cent AER / Gross

- Cynergy Bank – 4.3 per cent AER / Gross

- Nottingham BS – 4.25 per cent AER / Gross

- Skipton BS – 4.11 per cent AER / Gross

- Tesco Bank – 4.11 per cent AER / Gross

- Marcus by Goldman Sachs® – 4.01 per cent AER / 3.94 per cent Gross

- SAGA – 4.01 per cent AER / 3.94 per cent Gross

LATEST DEVELOPMENTS:

- Savings crisis as bank customers risk losing more than £500 after 'falling into account trap'

- State pension alert: Britons could get 'early access' to payments under DWP proposal

- Savers urged to 'act swiftly' as inflation and interest rate cuts 'hit' returns

Rachel Springall, a finance expert at Moneyfactscompare.co.uk said: "Providers have been making rate increases across the top savings rate tables over the past week, with notable attention set on short-term fixed bonds and fixed cash ISAs. Savers may then be pleased to see some competition if they are looking to secure a guaranteed return on their cash.

"The one-year fixed bond sector felt the most notable tweaks, with several providers improving rates or launching new deals in the top rate tables, including Cynergy Bank, Vanquis Bank, LHV Bank, Castle Trust Bank, Zenith Bank (UK) Ltd, Family Building Society, Close Brothers Savings and GB Bank.

“If savers are concerned interest rates are doomed to fall towards the latter end of this year and into the next, then they may prefer to lock into a longer-term fixed bond. Thankfully, there have been several challenger banks increasing rates in the top rate tables over the past week, which include some new market leading offers.

“Savers will breathe a sigh of relief that the Bank of England Base Rate remained on hold this month, however, they must be sure to review their rates and switch if their loyalty is not being repaid. Challenger banks and mutuals are offering some of the best returns on the market, so it is imperative savers look beyond the high street banks when comparing savings rates.”